Front Office

Trading and portfolio management to make better decisions

Facing lower returns, the front office is severely pressed to cut costs, boost performance, comply with ever-increasing regulatory requirements, and deliver exceptional client service. Meanwhile, businesses must be able to add products quickly and support new product types like carbon trading in the burgeoning ESG arena, while managing flow products efficiently.

Volatility spikes (pandemic effects, central bank interventions, geopolitical events) exacerbate challenges – highlighting the importance of agile infrastructures and integrated solutions so firms can implement changes swiftly.

To achieve trading and portfolio management objectives and gain competitive advantage, firms need to fortify their front offices by adopting:

- Tighter integration: front-to-back

- A data-driven approach

- A single source of truth

- Trading modernization through digital transformation

Our Front Office Trading Solution

We provide sell-side and buy-side firms with an all-in-one sales and trading platform covering their specific needs via our Front Office and Portfolio Management Workstations.

Our comprehensive cross-asset coverage of cash and derivatives products includes FX; Money markets; Fixed income; Securities finance; Interest-rate derivatives; Structured finance; Credit derivatives; Equities; Commodities; Synthetic financing.

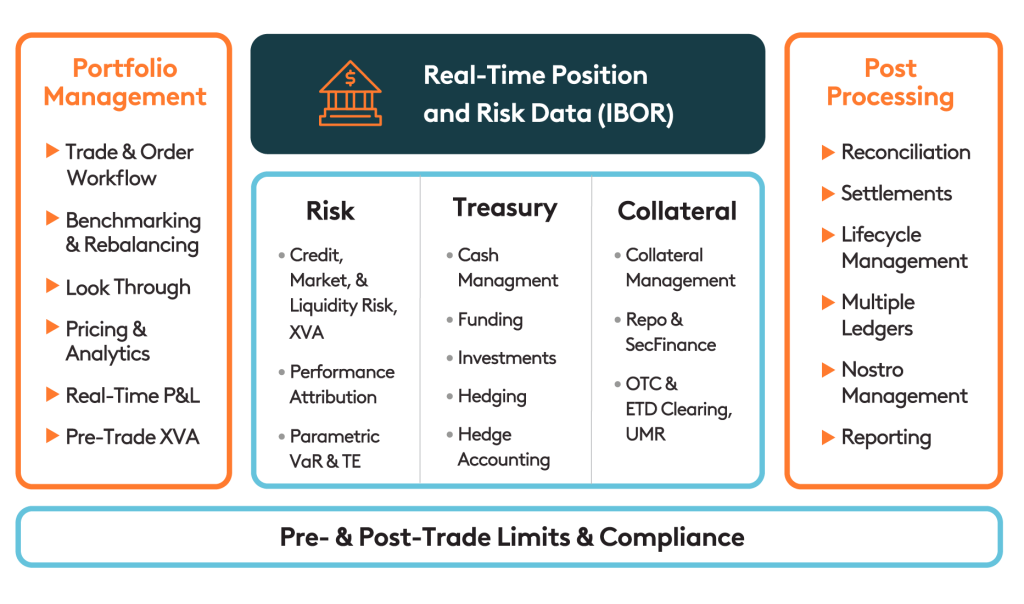

With our front-to-back integrated platform, you have instant access to all the pre-trade information you need to optimize resource allocation, i.e.: capital, collateral inventory, liquidity, all XVA flavors, and cleared and uncleared margins. And we deliver real-time risk and position data (IBOR) that bridges trading and portfolio management activities.

Our Workstations deliver:

- Real-time desk risk, positions, and market data

- Comprehensive real-time analytics

- Interactive, configurable dashboards to efficiently manage intraday risk and valuation

Our solution provides a consistent cross-asset workspace that enables you to make highly informed, rapid decisions and optimize your trading risk profiles and/or portfolio risk guidelines.

Front Office Workstation

Our best-in-class sales and trading platform offers the real-time analytics and comprehensive market and risk data you need. With our dashboards and tools, you can consistently monitor and manage your cross-asset portfolio of cash and derivatives products.

With the Workstation’s extensive capabilities, you can easily explain and decompose your trading activity all in real time.

Key Benefits:

- Access real-time data and advanced analytics to enhance decision making

- Configure or customize pricers to manage exotic and highly structured trades

- Simulate trading strategies and structures in the what-if sandbox

- Rely upon transparent pre-trade limit and compliance checks

- Book trades in a few clicks via predefined templates

- Monitor live positions, risk, and P&L using dashboards per asset class and user profile

Portfolio Workstation

With our consolidated, transparent view of portfolio and fund activities across investment functions, you gain scalability, efficiency, confidence, and TCO optimization. Our integrated command center delivers:

- Real-time portfolio insights

- Instant order generation

- Centralized enterprise-wide transaction, position, return, and risk data

The Workstation integrates with our multi-asset trading, risk, and collateral solutions, and you can leverage our centralized solution for compliance checks and connection to third-party platforms.

Key Benefits:

- View aggregated investment information across multiple portfolios

- Take immediate actions on position sizing/vetting via pre-trade compliance and analytics

- Sandbox what-ifs for single orders and bulk rebalancing

- Save/confirm decisions as orders or trades

- Assess portfolio risk in real-time

- Support intraday trading activity with cash inflows, redemptions, corporate actions, and third-party market data

- Generate an investment book of record (IBOR) to share across the firm

- Deliver best-practices client service enhanced with e-Portal channel capabilities

Benefits for You

Fast analytics, better decisions

Our configurable, interactive desk/portfolio-level customizable dashboards enable you to operate strategically and efficiently. We provide you with essential views including market data, live risk P&L, pricing, trade entry, risk and scenario analysis, centralized apps, and up-to-date position monitoring and marking.

End-to-end front-office digitalization

Through technology, data, and analytics, we enable you to transform how you manage your processes and serve your clients. Our low-touch/no-touch digital channels (e-Portals) allow your clients to self-serve, efficiently helping you to scale revenue and increase market share.

Single source of truth

Our data-driven solution is architected to ensure that all trading, market, pricing, sensitivity, and risk data inputs are fit for purpose and used consistently throughout all trading and investment processes.

Strong risk management

With access to real-time information, drilldown to trusted data, seamless processing, and user-friendly dashboarding and visibility. you can easily manage to your limits, P&L risk, and/or portfolio guidelines.

Front-to-back integration

Designed to interface seamlessly with your middle- and back-office (post-trade) functions, our solution enables you to leverage the single source of truth to achieve accuracy, efficiency, and auditability.

Confident compliance

With our front-office and portfolio workstations, you can rely upon vetted shared data for confident, compliant intraday activity. This strong, transparent data foundation enables reliable client and regulatory reporting, strengthens efficient compliance, and empowers strong defense of audits and examinations.

Related downloads