The Basel IV Parallel Run Commences

The start of the 2023 parallel run serves as a reminder to other Swiss entities that their compliance and reporting deadlines will soon follow. It is also the first tangible step in the market’s adoption of final Basel III rules as evaluated within the consultation period ending on October 25, 2022. The implementation of the final circulars, potentially carrying further rule updates driven by findings from the consultation period and parallel-run impact studies, is set for January 2025. This includes the move to adopt the Fundamental Review of the Trading Book (FRTB) aligned calculation methods, which brings Switzerland’s market-risk regulatory framework closer to EBA regulated jurisdictions. FRTB is already a disclosure requirement under EBA COREP and will become the driver for market- risk capital requirement in 2025.

In addition, this emphasizes the imminence of Basel IV adoption across the globe after delays owing to the pandemic and other factors. Switzerland is early out of the gate in Europe with its January 2024 target date for applicability of Basel III final reforms, as is Canada in the Americas with its first report filing date as early as April 2023.

Early out of the gate, Switzerland’s move emphasizes the imminence of Basel IV adoption across the globe.

Basel IV Regulatory Compliance Timelines

A Strategic Transition Under Close Supervision

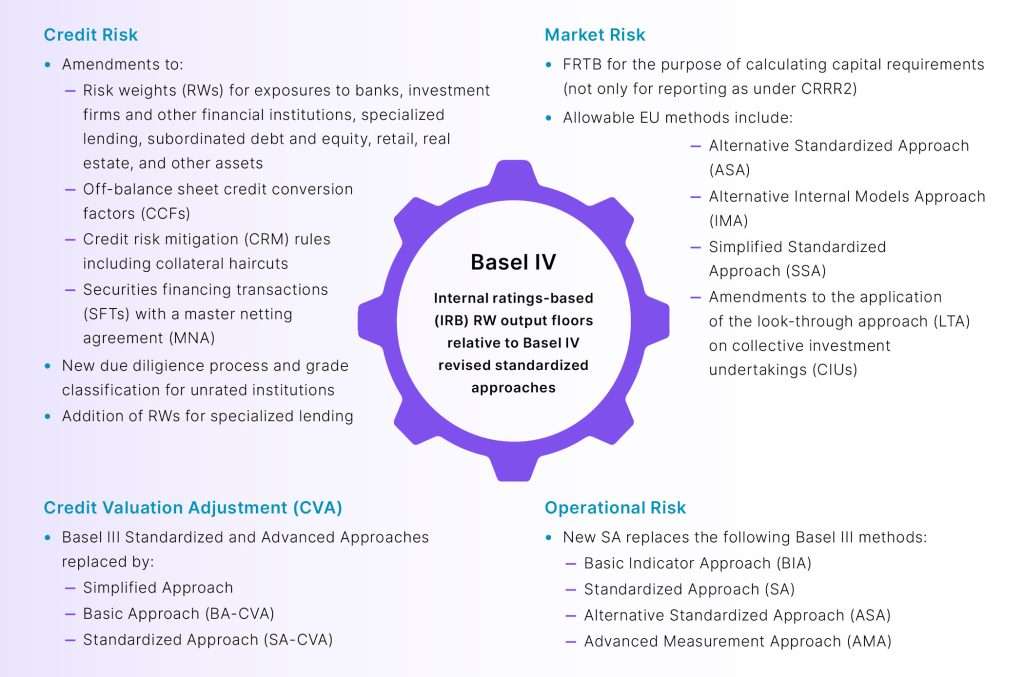

Indeed, the early Swiss action effectively gives banks and financial institutions across Europe a detailed preview of what they may need to do when their national/regional regulators bring Basel requirements into force. Regardless of jurisdictional interpretation, the transition to Basel IV requirements represents a major increase in calculation scope and complexity with end-to-end impacts, as indicated by the following listing of the most significant rule changes.

Basel IV Rule Changes

Regulators and supervisors will closely follow the quality and timeliness of compliance and the impact of Basel IV reforms on the health and stability of capital markets. Reporting institutions are expected to undertake strategic implementations of the new global rules. Switzerland plays a central role in the global financial markets and among BCBS members; and Swiss regulators have high expectations. Thus, banks are under pressure to deliver high-quality results with their first submissions.

Therefore, a key takeaway from Switzerland’s action is that to ensure compliance at go-live, all firms, even those not required to execute parallel runs or participate in studies beforehand, should invest in tackling the technical complexities and functional impacts brought by their Basel IV implementation projects as early as possible.

Switzerland’s Interpretation – The Primary Changes

FINMA and SNB used the BIS Basel III final guidelines as a starting point and made modifications to their locally codified implementations that account for the Swiss market’s unique characteristics and regulatory concerns. The resulting requirements affect all FINMA/SNB-regulated banks. The reforms are especially relevant for IRB banks, large retail banks, and capital-markets businesses. These entities will find adaptation challenging, given the primary changes summarized here.

Capital Requirements

FINMA/SNB made three primary changes. They clarified the capital buffer, defined new CET1 capital deductions, and introduced an IRB output floor to be phased in over three years according to BCBS’ schedule, though Swiss entities will be able to transition over five years, from 2024 to 2028.

Operational Risk

The regulators eliminated previously available approaches and, under Basel IV rules, have mandated a unified SA that is driven by a business indicator and an internal loss multiplier based on historical performance.

Credit Risk

The primary changes pertain to certain revolving retail exposures, privately insured mortgages, residential real-estate exposures, and the elimination of the IRB scaling factor. In particular, there are major changes to the RW treatments of real estate-secured exposures.

Leverage Ratio (LR)

FINMA/SNB made changes to the G-SIB LR buffer and other leverage requirements such as the treatment of SFTs and off-balance sheet items.

Other Changes

These include a revised CVA framework that increases risk sensitivities.

Risk-Sensitive Calculations with Tangible Capital Implications

Critical to accurately implementing the new Basel IV requirements is incorporating risk sensitive calculations. Firms must strategically source new data elements to execute these calculations and comply with new reporting requirements. Therefore, upstream data lakes/feeds will be in a state of flux requiring additional governance, controls, and potentially manual supplements and/or additional interventions if strategic changes are not implemented in time.

More importantly, the mechanics of key calculations have increased in complexity, especially for banks using advanced approaches. This means firms must validate the new calculation methodologies and results and become familiar with what is correct/optimal. To meet these requirements, financial institutions more than ever before will view transparency and deep drilldown as a must-have.

The introduction of the IRB output floor creates the need to run data sets under both the IRB and standardized approaches. Firms must be prepared for higher processing volumes not just from expanding records and attributes but also additional calculation executions to satisfy requirements for the output floor, LR, and large exposure (LE). This creates pressure on the end-to-end performance, storage efficiency, and parallel execution capabilities of their regulatory reporting automation systems. Considering the potential capital implications, the impact of the IRB output floor may encourage complying banks to develop optimization in their business dealings and strategies to effectively position themselves and remain competitive. For this, the ability to trace and attribute capital costs to specific lines of business – and to individual records among vast data sets – is key.

Ideally, all firms — even those not required to execute parallel runs or participate in studies beforehand — should invest in tackling the technical complexities and functional impacts brought by their Basel IV implementation projects, as soon as possible.

Increased Disclosure Requirements

With the significant changes to data sourcing and calculation complexities, come new disclosure requirements characterized by increased granularity. The ramp-up in data requirements and complexity encourages increases in aggregating data for performance. Firms will need to balance this with retaining details which provide traceability and visibility into the drivers behind reported results. When systems lack transparency and issues are only detected at the reporting level, investigations are slow and remediations may be impossible against reporting deadlines. Lastly, regulators increasingly expect overlapping/interconnected disclosures to be reconciled and fully auditable.

Streamline Your Basel IV Journey

The Swiss final Basel III updates, parallel runs, and compliance deadline necessitate processes and an architecture that integrates data, calculations, reporting, and analytics across trading and banking books. This calls for a single platform with strong transparency, reconciliation, and auditability characteristics. At this critical juncture, we invite you to talk to us about the Basel IV evolution and your overall regulatory compliance and reporting needs.