Collateral, Margin & Securities Finance

A single cash and security inventory to optimally manage margin calls, allocate collateral, and trade securities finance transactions

The growing need to integrate the collateral function with the treasury and capital market trading solution is driven by new pricing, hedging, and counterparty risk best-practices, and by larger regulatory frameworks including UMR, SA-CCR, and SFTR. Facing increased demand for non-cash collateral, firms also urgently need to optimize inventory to lend, pledge as collateral, or repo. Hampered by siloed data, systems, fragmented inventories, and manual processes, firms must access data and processes across the organization to optimize their assets and cover collateral requirements.

Our solution

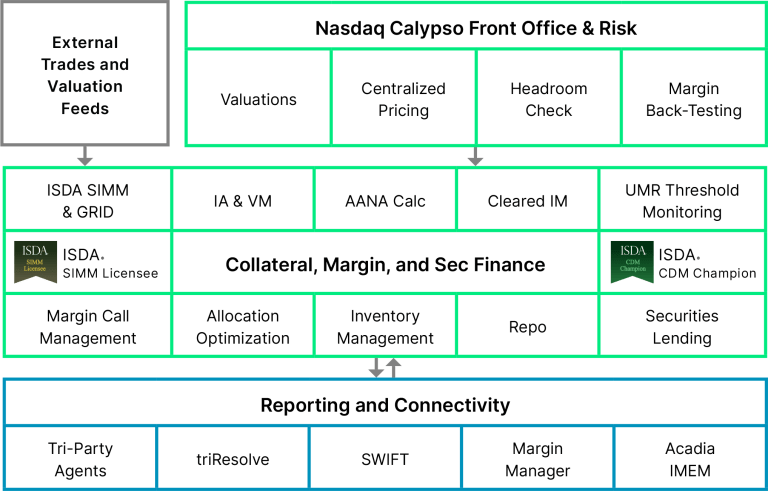

We help financial institutions reduce counterparty credit risk while strengthening processing and data consistency. With Nasdaq, you can meet today’s many challenges across margin calculations for cleared and uncleared trades, collateral management, and securities financing.

Our solution delivers a robust straight-through processing (STP) workflow that simplifies users’ needs in real time, provides comprehensive cross-asset coverage, and supports multi-agreements. Its rich connectivity enables seamless integration with utility services and tri-party agents.

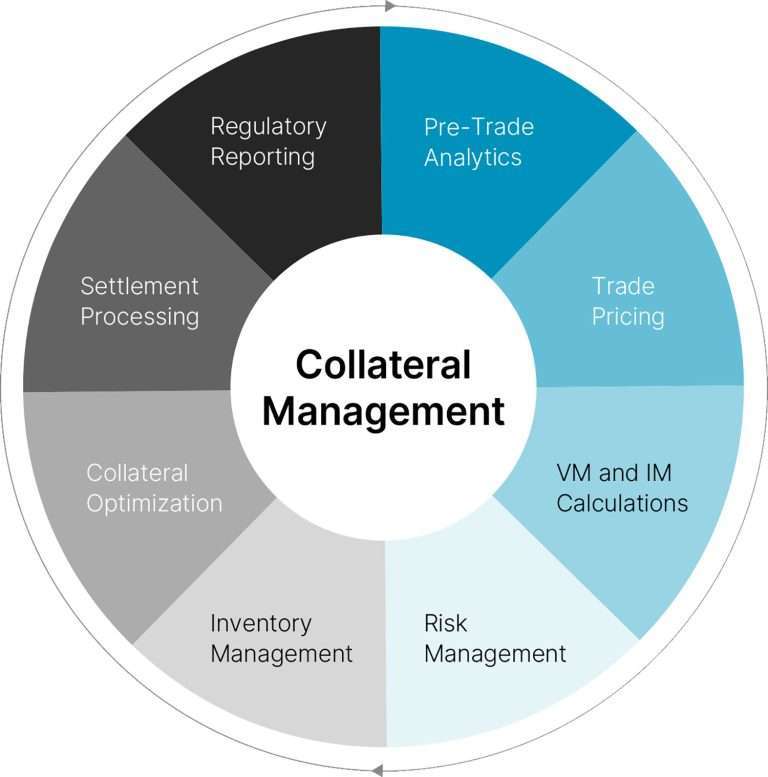

On a single automated workstation, we deliver seamless collateral inputs for:

- Pre-trade analytics

- Trade pricing

- VM and IM calculations

- Risk and inventory management

- Collateral optimization

- Settlement processing

With our flexible, ready-to-use securities finance solution, you can get started right away knowing that you can easily adapt it to suit your needs as you go.

Margin

Our margin module enables clients to transform a compliance exercise into an optimization process, via simulation and active monitoring, for ETD, OTC cleared and uncleared trades.

Benefits for You:

- Comprehensive coverage

Margin calculation across ETD, OTC cleared, and OTC uncleared trades with support for end users, FCMs, and CCPs.

- Greater visibility and accuracy

Headroom and initial margin trading limits, portfolio cross-margining, grid computing for rapid calculations, as well as all-in cost calculation.

- Increased flexibility

Standalone or integrated deployment with Nasdaq Calypso’s front-to-back solution delivered on a single technology stack.

- Simplified compliance

Fast track regulatory compliance, including Certified ISDA SIMM compliance, with holistic solutions that leverage standardized integrations.

- Margin Optimization

Reduce exposure before managing collateral by running What-if across OTC cleared and OTC uncleared margin. For OTC uncleared, optimize at the CSA Level by comparing across currencies and optimize the exposure by simulating trades across accounts as well as SIMM vs Grid.

- Beyond Calculating IM

User friendly dashboards, AANA Calculation, group threshold monitoring, back testing, and external data integrations offer a complete margin solution, going beyond just an IM calculation.

Collateral

Our Collateral Management platform helps clients manage all their repo and securities lending activities, enabling them to meet their trading, financing and collateral needs, thus optimizing the value of their portfolio.

Benefits for You:

- Risk reduction

Reduce counterparty credit risk, especially in terms of risk mitigation for OTC or ETD, cleared or uncleared, derivatives trading. Ensure full collateralization for securities financing transactions in real time.

- Comprehensive coverage

Supports any agreement type, is fully multi-entity and able to manage any complexity of legal entity structures.

- Optimal inventory usage

Centralized inventory provides increased visibility into collateral positions, exposure netting across multiple business lines, optimal allocation and minimal deployment of cash collateral.

- Holistic view

Provides a single solution to manage all exposures that need to be collateralized.

- Increased automation

Achieve faster processing time and eliminate manual interventions in processing margin calls

- Utility connectivity

Achieve end-to-end STP Nasdaq Calypso’s connectivity to Acadia MarginManager and triparty agents.

Securities Finance

Our Securities Finance Solution helps clients manage all their repo and securities lending activities, enabling them to meet their trading, financing and collateral needs, thus optimizing the value of their portfolio.

Benefits for You:

- Integrated, comprehensive coverage

A complete front-to-back solution with support for all trade, maturity types, and lifecycle events across both repo and securities lending as well as full support for stock and cash corporate actions.

- Optimized inventory

Leverages Nasdaq Calypso’s, comprehensive real-time inventory to display all positions and balances of repo, securities lending and collateral across bonds and equities.

- Increased accuracy and control

Rich functionality including P&L reporting, risk analytics, tools for regulatory compliance as well as the ability to trade, drill down, or report on all of the required transactions.

- Increased visibility and improved ROI

Achieve a consolidated view of cash and securities inventory, enhancing the ability to manage and reduce risk and improve ROI.

- Reduced funding costs

Collateral trading desks take advantage of our securities finance front-to-back office to access repo and securities lending markets in order to release contingent liquidity and reduce overall funding costs for the enterprise.

- SFTR reporting requirements

Meet ESMA reporting obligations using Nasdaq Calypso’s full SFTR reporting solution.

Reconciliation

In the context of clearing or bilateral agreements, capital markets users must reconcile trades and positions. An intraday reconciliation capability is a must-have to quickly and cleanly resolve discrepancies and thereby reduce disputes and avoid late fees and losses.

This capability enhances our core clearing solution’s reconciliation functionality. You can make quick decisions on the various functions you perform – intraday and end-of-day.

Benefits for You:

- Dashboard summarizing calls for action

- A no-code user experience

- Granular access permissions

- Data standardization, transformation, aggregation, and segregation

- Multi-key and selective matching

- Integration via REST API

Benefits for You

Consolidated and connected

With full visibility into the entire collateral and securities financing lifecycle and support for an exhaustive range of functionalities, you can consolidate all of your exposures, from any derivatives or securities financing trading, in a single place. Real time connectivity to collateral utilities and tri-party agents provides a single up-to-date view of and the current status of all of your exposures

Centralized inventory

With consolidated cash and security collateral and inventory management updated in real time, you can optimally cover all exposures. The solution’s processing and accounting functionalities include custodian notifications, failed deliveries, and SWIFT support enabling fast reconciliation.

Automated and configurable

Rich out-of-the box fully automated processes are easily configurable based on user preferences and client schedules. You can quickly optimize your margin calculations, collateral, and enhance business risk management. The solution’s automation, consolidation, and cloud-enablement enhance TCO reduction potential.

Full securities finance trading and lifecycle

The solution’s specialized functionalities covering repos, securities lending transactions, and SFTR reporting include user-defined reports, analytics, and stress-testing. We enable users to easily manage the trade lifecycle, end-to-end.

Holistic, validated margin coverage

Our suite of margin-exposure coverage includes VM, IA, Grid, and ISDA‑certified SIMM and IM for cleared trades. Users leverage this validated coverage for margin calculation, what-if analysis, and threshold monitoring. Automated, transparent calculations drive efficiencies, and enable confident decision-making and reporting.

Future-proofed and optimized

Our cloud-enabled automated solution provides you a single foundation to centralize collateral management through the trade and processing lifecycle, achieve data consistency, optimize collateral inventory, and meet changing regulatory requirements such as UMR.

Related downloads

"TCS is delighted to be an Certified Implementation Partner for Nasdaq Calypso & Nasdaq AxiomSL. We look forward to combining our deep domain knowledge of the capital markets and advisory-led approach with Nasdaq’s industry-leading capabilities and solutions to provide top-notch service to our clients."

"To be appointed as an Certified Implementation Partner for Nasdaq Calypso & Nasdaq AxiomSL is a testimony to our more than eight years of collaboration. This will spur our company to break new ground, implementing the Calypso Treasury solution beyond Africa."

"Quinnox is thrilled to be an Certified Implementation Partner for Nasdaq Calypso & Nasdaq AxiomSL. Our long-standing collaboration focuses on delivering top-notch solutions for financial institutions, emphasizing value, and fostering sustainable growth. With almost two decades of partnership, we're eager to continue our journey of innovation and transformation with Nasdaq."

"To be an Certified Implementation Partner for Nasdaq Calypso & Nasdaq AxiomSL is to embody a commitment to exceptional expertise, unwavering dedication to client success, and a profound understanding of cutting-edge solutions. It's about providing seamless, tailored implementations that empower businesses to thrive in an ever-evolving digital landscape in the financial sector. It also signifies Exadel’s dedication to delivering excellence and equipping organizations with the full potential of Nasdaq's advanced solutions."

"We've been Nasdaq partners since 2012 and look forward to the next chapter of this journey. The recognition as a trusted Certified Implementation Partner program means a lot to us. We are committed to delivering to the highest standards for Nasdaq Calypso and AxiomSL product lines."

"It was an informative and compact training program. Ram covered all the areas of the course brilliantly. Also had the opportunity to discuss queries on the go, those were answered promptly.

All the topics were just great, I found it all right. I am sure the practice sessions in training would help the team put them to use in future projects"