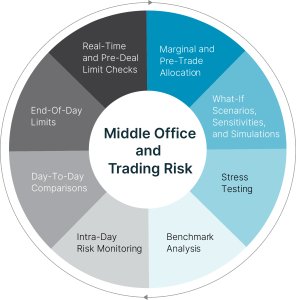

Middle Office & Trading Risk

Integrated risk analytics and compliance management platform to make faster and better trading decisions

Firms are trading ever larger derivatives volumes as they address new market demands and incorporate financial innovations. The total cost of trading is also increasing driven by larger trading volumes and, in addition to existing XVA spread and margin requirements, new complex regulations such as Basel III’s FRTB and SA-CCR. In this challenging environment, it is a strategic imperative that firms can estimate –during the pre-trade phase –the impact of a trade on their market, counterparty credit, or liquidity risk profiles. Having this intelligence prior to executing a trade is key to running a profitable and compliant trading business. Firms are trading ever larger derivatives volumes as they address new market demands and incorporate financial innovations. The total cost of trading is also increasing driven by larger trading volumes and, in addition to existing XVA spread and margin requirements, new complex regulations such as BaselIII’s FRTB and SA–CCR. In this challenging environment, it is a strategic imperative that firms can estimate –during the pre–trade phase –the impact of a trade on their market, counterparty, credit, or liquidity risk profiles. Having this intelligence in advance of executinga trade iskey torunning a profitable and compliant trading business.

Market Risk Solution

Our cloud-enabled platform enables users to benefit from a real-time, 360° view of trading portfolio risk profiles underpinned by comprehensive internal and regulatory credit, market, and liquidity risk analytics.

In addition to generating official end-of-day (EOD) metrics and reports, we enable intraday risk monitoring, real-time pre-deal limits checks, what-if simulations, and stress scenarios. We provide a risk, P&L and liquidity management solution for cross asset, cleared and uncleared businesses. It allows users to better price and hedge their risk exposures and to forecast their funding and capital needs. With our middle office and trading risk platform you can optimize profitability in a world of volatile markets and ever-changing regulatory environment.

Market Risk Analytics

Key risk metrics include:

- VaR and expected shortfall (ES) models: parametric, historical, and Monte-Carlo

- Stress MTM, P&L, sensitivities, scenarios and risk attribution

- Configurable confidence levels, EWMA filtering, kernel smoothing

- Incremental, marginal, upside VaR, what-if

- Absolute and relative VaR vs.reference benchmark

- Backtesting using hypothetical or actual P&L approaches

Key market risk analytics for FRTB include:

- Centralized calculations across trading systems

- Regulatory delta, vega, and curvature sensitivities

- Default risk charge and residual risk add-ons

- Support of national/jurisdictional discretions

- UMR- and FRTB-compliant backtesting

XVA

We provide real-time, intraday, and EOD XVA metrics to support your trading, accounting, hedging, and regulatory reporting.

XVA metrics:•Risk–neutral and real–world calibration models•LMMandHull & Whitediffusion models•Marginal and pre–trade incremental XVA•Post–trade XVA optimization•XVA sensitivities for Basel III’sFRTB SA–CVA•XVA explained

Key features:

- Single pricing layer between XVA software and front office

- Fully consistent with our front-office pricing engine and collateral functionality

- One set of CSAs and legal agreements shared with back office (BO) and collateral functions

- Performance accelerated by mathematical optimization

Fully consistent with our front-office pricing engineand collateral functionality•One set of CSAs and legal agreements shared with back office (BO)and collateral functions•Performance accelerated by mathematical optimizationFully consistent with our front–office pricing engineand collateral functionality•One set of CSAs and legal agreements shared with back office (BO)and collateral functions•Performance accelerated by mathematical optimization

XVA metrics:

- Risk-neutral and real-world calibration models

- LMM and Hull & White diffusion models

- Marginal and pre-trade incremental XVA

- Post-trade XVA optimization

- XVA sensitivities for Basel III’s FRTB SA-CVA

- XVA software explained

Fully consistent with our front-office pricing engineand collateral functionality•One set of CSAs and legal agreements shared with back office (BO)and collateral functions•Performance accelerated by mathematical optimizationFully consistent with our front–office pricing engineand collateral functionality•One set of CSAs and legal agreements shared with back office (BO)and collateral functions•Performance accelerated by mathematical optimization

Initial Margin

We deliver a comprehensive margin calculation solution for all instrument types covering ETD, OTC cleared, and OTC bilateral trades.

Our margin calculations can be used for more than 50 exchanges at every stage of the trade lifecycle and for stress testing.Key features:

- Native integration with our clearing and collateral management solutions enables an end-to-end collateral workflow

- Compliant with Basel III UMR regulation

- Latest ISDA SIMM and schedule/grid methodology

- AANA computation

- UMR dynamic and static backtesting

- ICE IRM 1.0 and 2.0

- CME SPAN and SPAN 2

- EUREX PRISMA

Counterparty Credit Risk Analytics

We deliver a complete range of analytics that enable you to assess the credit and counterparty risk of your transactions through the complete trade lifecycle.

Key features:

- Exposure at default (EAD) measures based on CEM, SA-CCR, and Monte-Carlo PFE methodologies

- Native integration with our front-office (FO) solution for consistent derivatives pricing

- Collateral information to enable comparison of collateralized and uncollateralized exposures

- Marginal allocation of a portfolio EAD per netting set and per trade

Profit & Loss

Key features:

- EOD official P&L

- Live P&L

- P&L explained and attribution metrics

- Actual and hypothetical P&L for backtesting

- End of Day and real-time pre-deal check stop loss limits

- Cloud ready

Limits & Compliance

Our clear, consistent implementation of internal risk control frameworks and regulatory rules enables confident intraday and EOD compliance for trade lifecycles and/or portfolio risk profiles and integrates seamlessly with our solutions front to back.

You can easily keep your trading activity within pre-defined boundaries via our intraday checks on eligibility rules and risk limits.Key features:

Comprehensive limit monitoring

- Complete set of limit risk metrics: Counterparty Credit Risk (CEM, SACCR, Monte-Carlo PFE), Market Risk (duration, sensitivities, VaR), Issuer Risk, Concentration Risk, Settlement Risk, Liquidity Risk and Stop-Loss

- Baseline updates facilitate intraday and pre-trade limit processes

- Top exposures, breaches, and exceptions tracked via dashboards

Flexible exposure measures

- Pricers

- User-defined formulas

Compliance tools

- Dashboard

- ESG-based rules

- Pre-and post-trade compliance

- Eligibility checks

Why Nasdaq Calypso Middle Office & Trading Solutions:

Natively integrated with Nasdaq Calypso's front-to-back platform

Our trading risk metrics are consistent with the front-office pricing engine by design. This significantly reduces implementation and reconciliation time and effort.

Regulatory analytics embedded in daily trading decisions

With access to regulatory metrics in intraday, real-time, and pre-deal check limits,we enable you to better capture and cascade regulatory cost and guidelines inside your organization.

360 holistic view of trading risk

We provide a comprehensive view of your trading portfolios’ risk profiles that combines internal and regulatory credit, market, and liquidity risk analytics.

Performant, scalable grid computing infrastructure

We leverage state-of-the-art technologies to provide the level of performance and quick response times your front-office users expect.

Real-time pre-deal limit checks

We deliver the ability to concurrently check new trades prior to executing them.

Interoperability via REST APIs

Using REST APIs, you can remotely control calls to the Nasdaq Calypso platform from other software – to produce regulatory analytics, read current limits usage, or perform pre-deal limit checks – for enhanced operating flexibility.

Cloud ready

Whereas our solutions can be utilized on-premises,they are designed to fully leverage the computing capabilities and benefits of a cloud deployment.