The Dance Of Transformation And Stability

The shift towards granular data reporting (GDR) in Asia-Pacific represents a significant evolution in the regional regulatory landscape as well as a reflection of global trends and the recognition of the power of data-driven oversight and enhanced-transparency evident in the European Central Bank standardization and harmonization of reporting requirements for banks, including the AnaCredit implementation and the revolutionary Integrated Reporting Framework (IReF) roll-out.

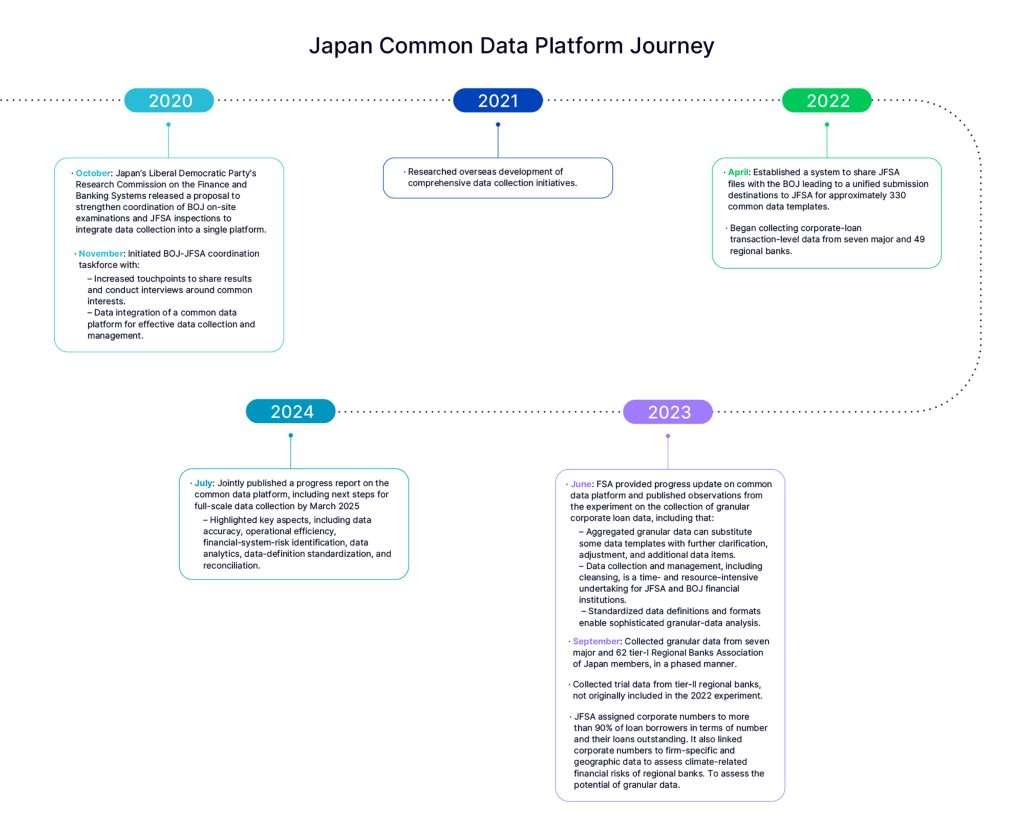

In the region, several countries – Australia, Hong Kong, India, Philippines, and Singapore – are leading the charge with comprehensive transformation programs away from traditional aggregated reporting to granular data collection. Nowhere is that more evident than in Japan, where the Bank of Japan (BOJ) and Japan Financial Services Agency (JFSA) are near the conclusion of a five-year experiment to remove overlaps between their supervisory and reporting frameworks. So far, efforts have included instituting common data templates, unified submission destinations, and a progress report for full-scale data collection by March 2025.

The BOJ-JFSA Granular Data Reporting Experiment

In their primary roles, the BOJ examines assets held by banks to monitor risks in the financial system, while the JFSA monitors banks’ internal management and governance. However, there are many overlaps in the types of data collected to achieve their respective objectives. With the government’s subsequent conclusion that such overlaps have led to operational inefficiencies for financial institutions, BOJ and JFSA have moved to centralize reporting into a common-data platform.

Key Asia-Pacific Comprehensive and Granular Data Initiatives

- Australia: APRA introduced Comprehensive Data Collection (CDC) to gather richer, more granular data, which is expected to improve data-driven decisions, optimize total cost of ownership (TCO), and increase operational efficiencies.

- Hong Kong: Hong Kong Monetary Authority (HKMA) implemented GDR to support improved surveillance and policy formation.

- India: The Reserve Bank of India (RBI) established the Centralized Information Management System (CIMS) to automate regulatory and supervisory submissions, replacing the existing XBRL system.

- Philippines: Bangko Sentral ng Pilipinas (BSP) rolled out FRP v15 XML Consolidation and the International Transactions Reporting System (ITRS) to monitor cross-border transactions and compile balance of payments statistics.

- Singapore: The Monetary Authority of Singapore (MAS)’s Data Collection Gateway (DCG) enhances data quality and streamlines submission.

Although the shift towards GDR is not without its challenges for financial institutions and regulatory bodies, the lessons learned from these early adopters – highlights the importance of strategic planning, technology investment, and collaboration between regulators, Reg Tech, and banks to ensure a smooth transition – are invaluable. By adopting best practices from these experiences, regulators and banks can mitigate risks and capitalize on GDR benefits, including improved surveillance capabilities, enhanced compliance, and operational efficiencies.

Global Data Reporting: Key Milestones, Synergies, and Challenges

The progress over the past five years on the common data platform is a testament to the natural synergies within Japan between the BOJ and JFSA requirements. However, there are also synergies outside as both Hong Kong and Japan have hit key milestones. Similar to an earlier experiment by the HKMA, JFSA conducted research using Machine Learning on time-series data from Credit Risk Information Integration Service (CRITS®) and other sources to measure explanatory variables for downgrading borrower classification from “normal” to “needs attention” or below and predict the downgrade probability in less than one year. This newly published paper demonstrates how JFSA envisions applying this business intelligence to their granular dataset, over time.

In the same paper, JFSA highlighted challenges in using anonymized corporate loan data from CRITS as well as the potential in using granular data with a broader counterparty scope of loans to corporates and individuals for more comprehensive analysis. This provides flexibility in aggregation and uses unique identifiers in the data to link to other external data and form a bigger dataset.

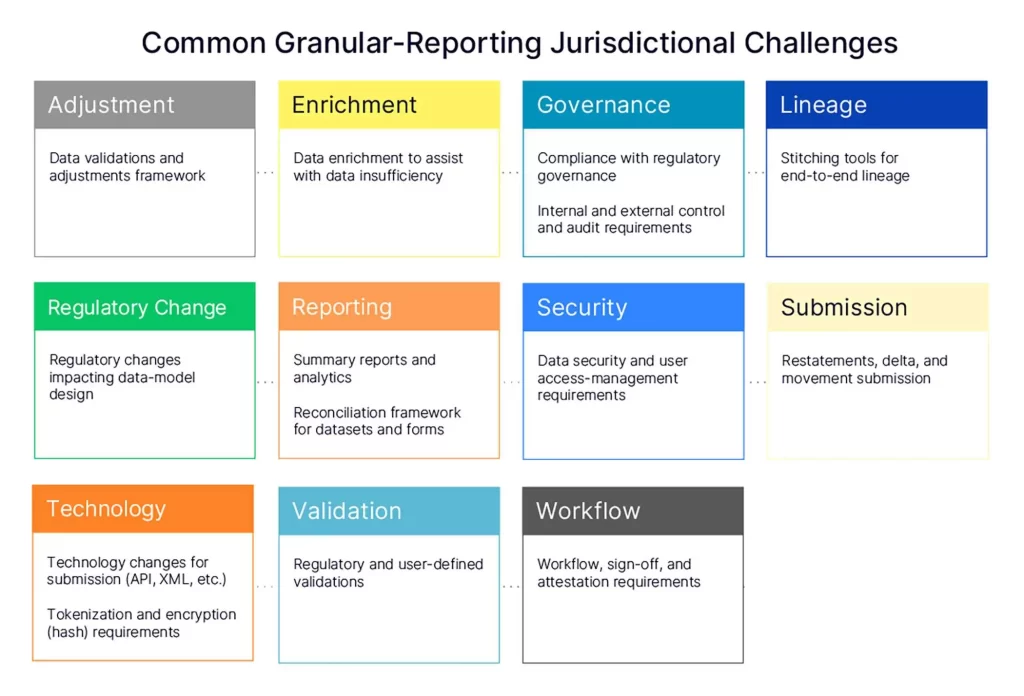

As more Asia-Pacific jurisdictions develop GDR requirements, reporting firms experience functional and technical challenges as they work to conform with complex regulations like Basel IV. In transitioning to GDR, banks and regulators will need to tackle the following common issues:

Bank Challenges

- Need for centralized, clean data sources required across all types of risk which are being measured in the Basel framework to ensure accuracy in the estimation of capital, liquidity, and leverage ratio variances.

- Increased granularity of adjustments changes as well as in the number of adjustments records and data fields.

- Sophisticated data-attestation and sign-off processes close to the data origination, early in the workflow.

- Ability to identify and submit a subset of data to meet delta submission and restatements.

- Changes in submission formats (APL/XML, etc.).

- Tokenization and encryption requirements to mask client-sensitive information

- Data lineage to understand end-to-end flow to prove data accuracy and detect and investigate anomalies.

Regulator Challenges

- Technical challenges to efficiently process and build analytics on a large volume of data.

- Ability to analyze a single source of data instead of each team monitoring at a pre-defined level of aggregation in form-based reports.

- Balancing between expanding data compliance to banks or innovatively analyzing macroeconomic problems.

- Ununiform regulatory definitions and data availability across entities and regulators (even within jurisdiction).

A Granular-Data Reporting Framework: Futureproofing

Japan banks can avoid some of the key problems that we have noticed in other countries, exemplified below, by proactively onboarding the common data platform (GDR framework) early in their transformation process:

- Reactive scramble and higher costs: Late implementation or waiting until GDR becomes mandatory can lead to rushed and potentially flawed system implementations, incurring higher costs.

– By proactively developing a strong end-to-end data-management framework and removing current reporting silos, banks can have a well-defined plan for data collection, storage, and reporting. This approach allows for more efficient use of limited resources.

- Data-quality issues and regulatory scrutiny: Without a GDR framework, banks are prone to inconsistent or inaccurate data spread across various systems. Cleaning this data becomes a significant burden when facing mandatory reporting deadlines.

– An early focus on GDR allows banks to implement data-quality checks and cleansing processes. This ensures the accuracy and consistency of reported data, minimizing the risk of regulatory scrutiny due to data quality issues.

- Regulatory friction and potential penalties: A rushed implementation can lead to compliance gaps, increasing the risk of regulatory penalties.

– By integrating a GDR framework, banks ensure that they have the systems and processes to comply with reporting requirements from the outset. This smooths the transition with regulators and reduces the likelihood of non-compliance and/or penalties.

- Missed opportunity to enhance risk management: Without a GDR framework, banks must rely on less granular data for assessment, limiting their ability to proactively identify and address potential risks.

– A GDR framework provides banks with access to a richer data pool. By analyzing this data, banks gain deeper, data-driven insights into their risk profile for more effective risk-management strategies.

- Competitive disadvantage and reputational risk: Banks that are slow to adapt to GDR risk lagging behind competitors who have a robust framework.

– An early focus on a GDR framework demonstrates the bank’s commitment to compliance and data-driven decision-making. This can enhance their reputation within the market and attract investors who value transparency and risk management.

In other words, they can take key steps that facilitate a successful GDR compliance

- Collect, consolidate, and cleanse data at the most granular level.

- Centralize regulatory classifications and data enrichment.

- Gain stakeholders’ confidence by instituting the correct reconciliation and analytics framework.

- Transition from siloed top-down reporting to a data-driven bottom-up reporting.

- Establish an operating model with the necessary workflows and user-access management

While there are challenges to unlocking the value of data for institutions and regulators, there is also hope or more proactively, preparation.

By deploying the appropriate GDR framework, instead of tactical solutions that simply address regulatory requirements, banks can smoothly navigate the transition, avoid costly missteps, and unlock the GDR benefits for improved risk management, regulatory efficiency, and a stronger market position. Not to mention, futureproof themselves for the next inevitable rounds of change.