Capital & Credit

Delivering consistency, control, and compliance in regulatory risk management

In the modern banking world, risk, compliance, and reporting teams face a myriad of evolving regulatory requirements emanating from Basel, the EBA, OSFI, the US Fed, and many regulatory jurisdictions and other frameworks and directives including CRR/CRD, IFR/IFD, broker-dealer net capital requirements.

Firms’ efforts to grapple with these challenges are often hampered by siloed data sources, manual processes, inconsistency across risk, finance, compliance, and reporting functions, and lack of timely, actionable risk information.

To strengthen their approach to global capital and risk management and reporting, firms must reassess their end-to-end approaches and seek best-practices to:

- Control complex data landscapes

- Optimize capital requirements

- Report to regulators accurately

- Reduce operational overhead

Our solution

Our consistent, transparent, automated approach to data management, calculation, and regulatory reporting accommodates the global capital and risk landscape’s regional and jurisdictional requirements.

Nasdaq AxiomSL ControllerView® platform, underpins our solutions powered by extensible data dictionaries and calculation engines.

Capital & Credit Solutions

RWA Capital Calculations

Key features:

- Drives efficient Risk Weighted Assets calculations across Basel Pillars 1, 2, and 3 requirements including anticipated changes

- Consolidates and organizes data efficiently and consistency across calculation purposes via jurisdictionally extensible data dictionaries

- Provides immediate access to Directives’ rule references

- Produces a range of RWA capital calculations across Credit, Market, and Operational Risk

- Drives Large Exposure, SCCL, and other required calculations

Generates jurisdictionally required regulatory reports including:

- EU EBA and UK FCA: Pillar 3 Disclosures and EBA COREP Taxonomy

- Canada OSFI: BCAR, Pillar 3, LRR, and NCR

- US: FFIEC 101/102, FR Y‑9C (Schedule HC R), FR Y-14, Call Report (RC-R), and FR 2590

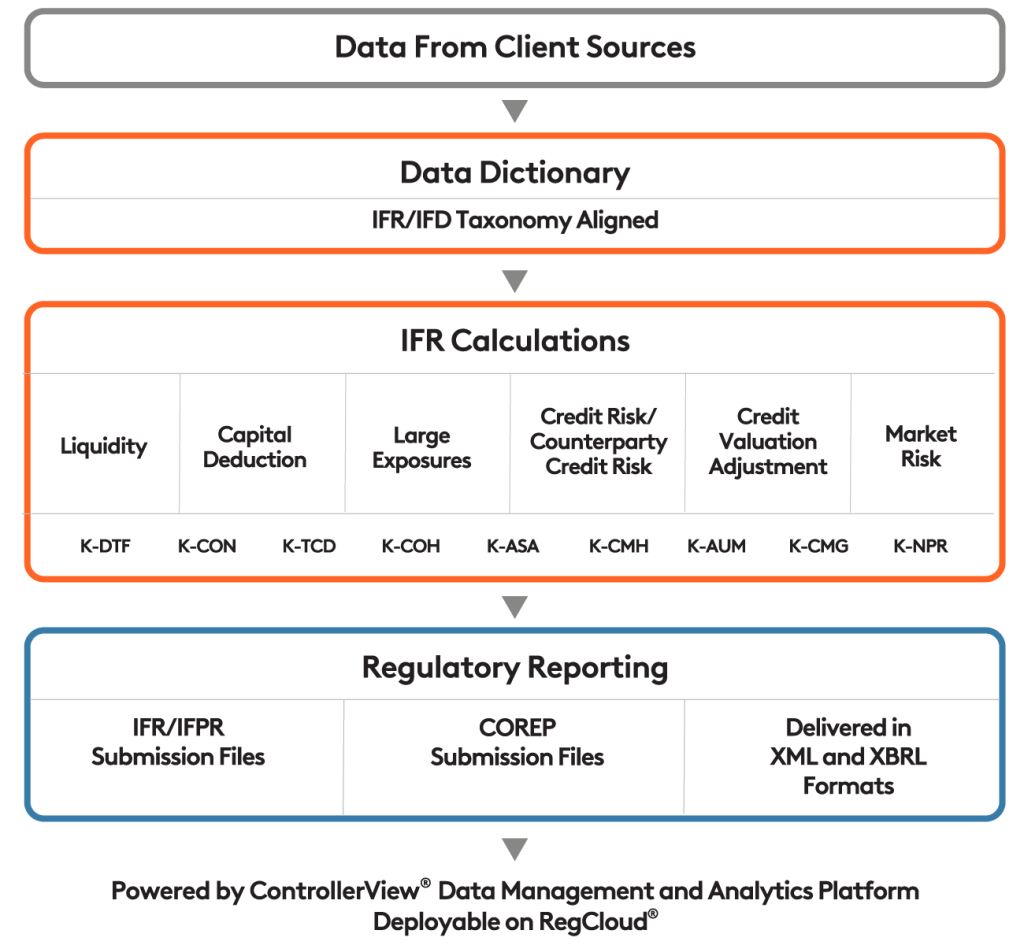

EBA IFR

Key features:

- Ingests balance sheet, EOD/intraday trade/position flows, and eligible liquidity assets

- Aligns with IFR/IFD regulation taxonomy requirements via a common data dictionary

- Computes necessary market risk and uses capital logic for CVA, credit risk/counterparty credit risk, and large exposure

- Covers capital deductions for COREP and liquidity for IFR

- Calculates IFR/IFD-defined K factors, including K-NPR, K-CMG, K-AUM, K-CMH, K-ASA, K-COH, K-TCD, K-CON, K-DTF

- Delivers COREP and IFR/IFPR reporting templates and submission files in XML and XBRL formats

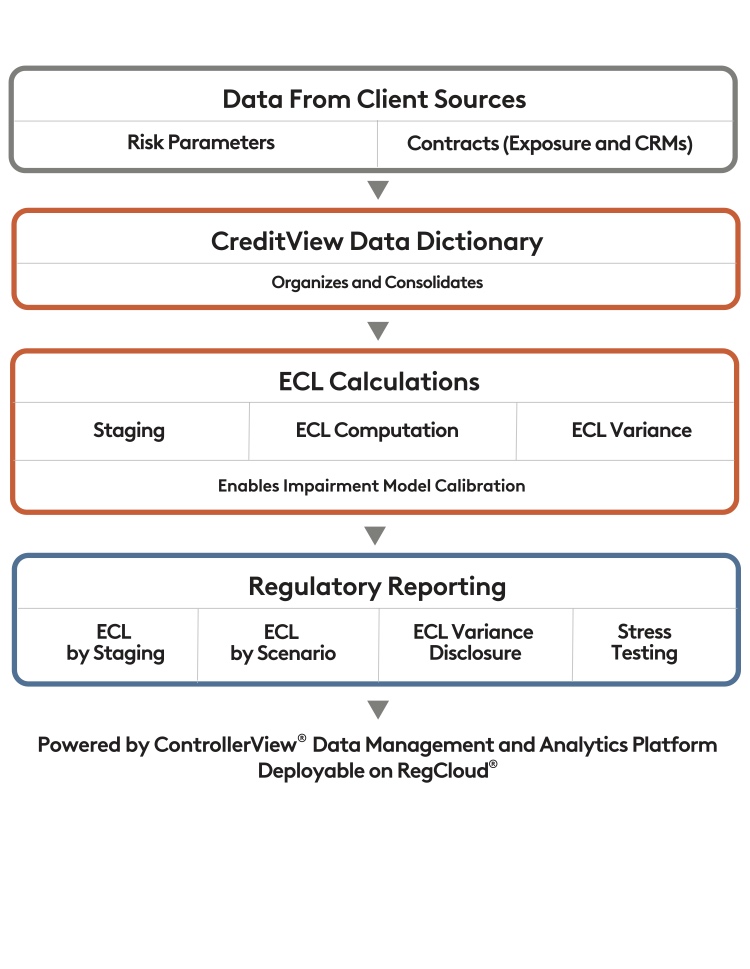

IFRS 9 solution

Key features:

- Consolidates and organizes contracts, counterparties, ratings, and risk-parameter data efficiently and consistently

- Enables impairment model calibration and management directly within the platform’s graphical user interface

- Computes staging, ECL, and ECL variance analysis at multiple granularity levels as required

- Generates transparent, connected regulatory reporting datasets such as ECL by staging, scenario, variance disclosure, and stress testing

- Provides fully automated change capture and management for data adjustments and business rules

- Enables monitoring and actioning via dashboards

- Tracks bidirectional lineage of client data across calculation versions and resulting ECL variances

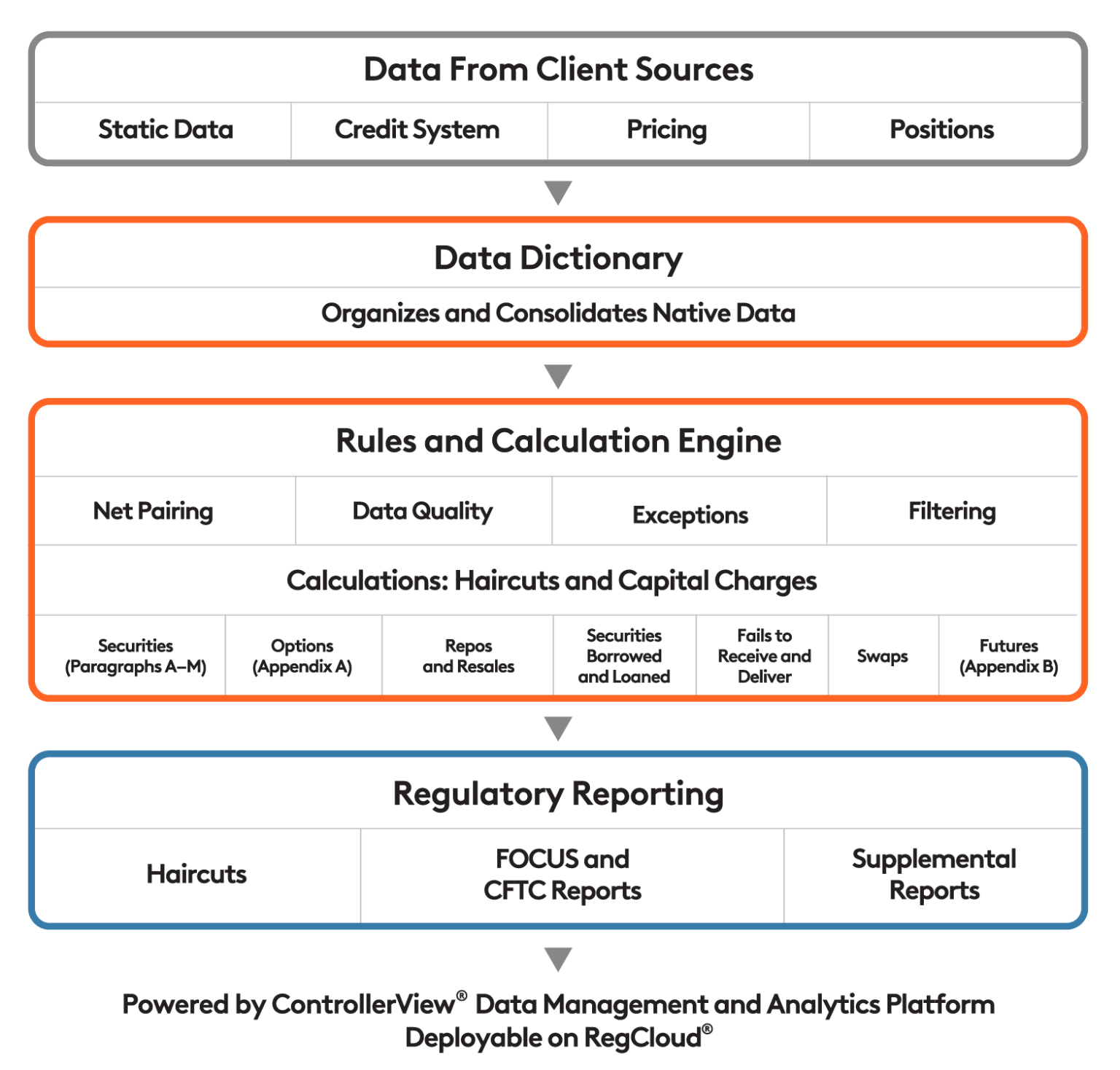

Broker-dealer Net Capital

Key features:

- Consolidates and organizes native data efficiently and consistency across risk calculation purposes via a data dictionary

- Moves positions into unique-to-purpose calculation modules via a common calculation

- Transparently reconciles flows of data in and out

- Computes haircuts and capital charges:

- Securities (Paragraphs A–M)

- Options (Appendix A)

- Repos and Resales

- Securities Borrowed and Loaned

- Fails to Receive and Deliver

- Swaps

- Futures (Appendix B)

- Produces SEC Rule 17a-5 FOCUS reports with full integration of Net Capital Calculation (Rule 15c3-1) and Customer Reserve Computations (Rule 15c3-3)

- Generates CFTC Swap Dealer reporting including BHC and NLA

- Enables direct uploads to FINRA Gateway and NFA WinJammer

- Facilitates MIS reporting e.g., variance and reconciliation

Benefits for You

Comprehensive

Our extensible data dictionaries provide business-friendly interface contracts to ingest and organise your data. Through a single user interface and software platform, control your data ETL processes, perform regulatory risk calculations and produce regulatory and bespoke reports.

Transparent

Cell-to-source-data drilldown available from each datapoint. Business rules through all processes are inspectable. This transparency provides you with BCBS239 compliance and audit-ready status at the platform level for all processes and submissions.

Flexible

Via our modular solution design, you can access comprehensive calculators, reporting dictionaries or templates only. Robust data adjustments options are available at every stage and on the reporting templates–with regulatory validations and audit trails.

Optimized

Proprietary collateral allocation and optimization processes shortcut complex implementations and minimize capital charges by optimizing collateral utilization within regulatory CRM rules.

Compliant

Bridging a large global client base, our industry experts help you make sense of evolving regulations. We continually monitor regulatory changes and provide timely updates to support successful regulatory submissions.

TCO beneficial

Our cloud-enabled single-platform approach reduces cost of onboarding additional jurisdictions, new functionalities, and adjacent regulatory and internal reporting requirements by leveraging existing data and business logic.